What Is Revenue From Property Taxes Usually Used for

Free education is an expensive public service and requires a significant source of funding. Many states impose limits on how local jurisdictions may tax property.

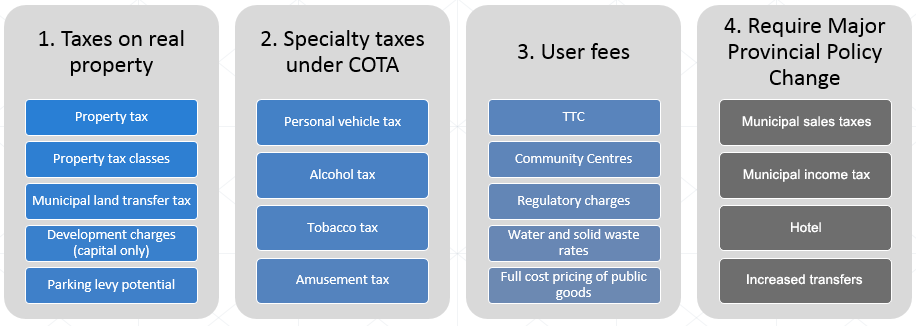

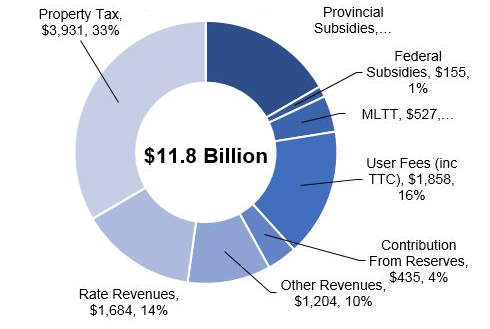

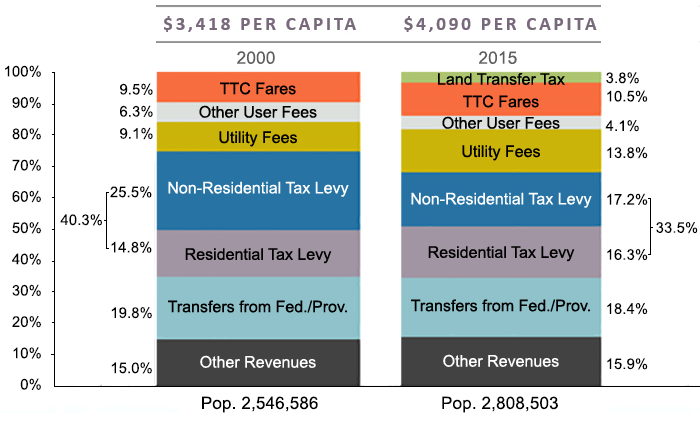

City Revenue Fact Sheet City Of Toronto

Set by the jurisdiction.

. The tax is administered at the local government level. Equation for Millage statutory tax rate Ra E-T AaWbAb Ra E-T AaWbAb Ra Tax rate. Property taxes in America are collected by local governments and are usually based on the value of a property.

Property tax is a tax assessed on real estate. Local governments use property tax revenue to fund important programs including. The property taxes are a significant source of local government revenues.

1 Assessment of the property value for tax purposes and 2 Property tax bill. Property taxes have proven to be an invaluable tool to meet the educational promises made to US. Not every state collects sales tax and not all those that do allow local governments to impose sales taxes.

Property taxes are often the most significant source of revenue for governments. Children especially those in underserved or poorer communities. The property tax typically produces the required revenue for municipalities tax levies.

Because the local sales tax rate is restored in full the property tax revenue currently used to backfill cities and counties for the loss in sales tax revenue will be allocated to K14 districts. Two parts to the rate. March 31 2022 Local governments collect tax revenue by assessing property taxes.

Tax revenues are used to finance the government and. It all depends on where you live and how your city county and state use the money they collect. For at least 100 years state and local municipalities across the country have used revenue from property taxes to help build and maintain schools and pay teacher salaries.

Some of the most common types of taxes include those on income purchases and real property. The money collected is generally used to support community safety schools infrastructure and other public projects. Although none of these entities will experience any change in overall revenue cities and to a lesser extent counties will receive a smaller share of the property tax than they.

Regardless of where you live if you want better services. Came from property taxes. Property taxes are just such a major revenue source.

Commercial real estate owners are then sent two notices relating to property tax due. Most property tax revenue flows to local governments and localities are reliant on property taxes to fund government services such as public education making up about 72 percent of all local tax revenue in fiscal year 2016. A disadvantage to the taxpayer is that the tax liability is fixed while the taxpayers income is not.

According to a comprehensive report published by the Lincoln Institute of Land Policy entitled The Property Tax-School Funding Dilemma half of all property tax revenue in the United States is used to fund public primary. They pay for schools parks and recreation government employees salaries and benefits transportation infrastructures local law enforcement and fire departments. The rate is generally represented by cents per 100 valuation ie.

E planned local government expenditure for the budget year T expected nonproperty tax revenue in that year Aa taxable or net assessed value of property in the lowest rate class Ab. When collected money is often used for infrastructure and education. In other words 1 for every 1000 of assessed value.

Where does sales tax go. In 2019 the Census Bureau estimated that 31 of all state and local revenue in the US. Tax revenue typically refers to monies collected by governments as the result of taxes imposed on their citizens.

Property taxes are just one of the forms of tax that most people need to pay in order to remain fiscally compliant. Property taxes are a major source of income for local and state governments and are used to fund services such as education transportation emergency. When you purchase a home or piece of property the tax you pay annually to local government for municipal services such as police and fire protection is.

050 per 100 A mill is 1 cent per 100 valuation so an increase of one mill wouldbe going from a tax rate of 050 to 051 per 100. Part of the revenue collected from property taxes is used to fund the public school system library fire department and other essential services. Property taxes pay for the services we use every day whereas our Canadian income taxes cover major things like health care and employment insurance.

Taxes are what pays for them. Overview of Property Taxes. The tax is usually based on the value of the property including the land you own and is.

Local property taxes fund schools fire departments and libraries and they can be a major source of funding for your city or county. There is usually a 30 to 60 day period between the time the assessment. When we pay property tax bill that money is used to maintain or build many things like - roads construction and maintenance government office buildings maintenance the local government staff salaries municipalities government run schools street lights public toilets etc.

City Revenue Fact Sheet City Of Toronto

No comments for "What Is Revenue From Property Taxes Usually Used for"

Post a Comment